The Evolving Face of the US Homebuyer: Affordability Challenges and an Aging Buyer Demographic

The National Association of Realtors’ (NAR) 2024 report paints a vivid picture of an evolving US housing market, one where affordability constraints and economic pressures are reshaping the profile of today’s typical homebuyer. These trends are altering the landscape of homeownership, with potential long-term impacts on the housing market and the broader economy.

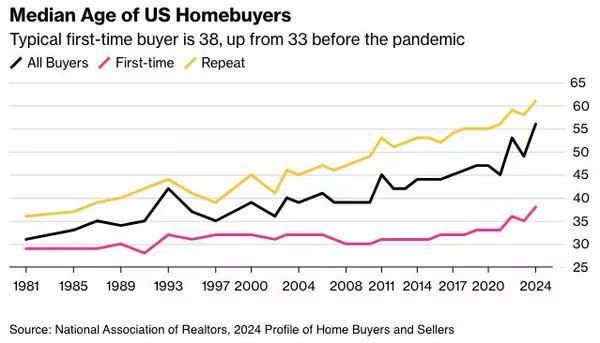

Rising Average Age of Homebuyers

The age of the average homebuyer has climbed steadily, now reaching a record high of 56 years old. For first-time buyers, the average age has risen to 38, nearly ten years older than it was in the early 1980s. This trend reflects the struggles of younger buyers, who often face financial obstacles that delay their entry into the market. Many younger individuals contend with high student debt, stagnant wage growth, and historically high home prices, all while mortgage interest rates add to their financial burden. The result? Younger prospective homeowners are often pushed to the sidelines, unable to compete with more financially established buyers.

Shifting Demographics: Single Women Rising in Homeownership

Another demographic shift noted in the NAR report is the rise in single female homeowners, who now make up 20% of recent homebuyers, while single men account for just 8%. This change highlights a shift in homeownership goals among single women and suggests greater financial independence and empowerment in this group. The trend also reflects broader social changes, where single women increasingly view homeownership as a valuable and attainable milestone.

A Market Favoring the Financially Secure

High prices and limited inventory have created what experts are calling a “bifurcated housing market.” Buyers who succeed in this market are often financially established, many bringing wealth accumulated through years of savings or equity from previous homeownership. These buyers can often make substantial down payments or cash purchases, creating a competitive advantage over first-time buyers who struggle with affordability and financing. As a result, homeownership is increasingly skewed toward older, financially stable individuals, excluding many younger and lower-income households from achieving the same goal.

Dwindling Share of First-Time Buyers

Perhaps the most telling indicator of these challenges is the decline in first-time buyers, who now make up just 24% of the market—a dramatic drop from the 40% share typical before the Great Recession. With affordability metrics at near-record lows, first-time buyers face a daunting path to homeownership. Rising interest rates and inflated property values exacerbate these challenges, leaving many young people locked out of homeownership and reshaping the market around older buyers without children at home.

A Glimmer of Hope?

While the NAR report reveals sobering realities, there may be a glimmer of hope on the horizon. Recent mortgage application data suggests that some sidelined buyers might be re-entering the market as interest rates stabilize. If this trend holds, younger and more diverse buyers may gradually return, which could lead to a more varied buyer profile over time.

At Havas Edge, we’re closely monitoring these demographic shifts to help brands understand and engage with today’s homebuyers effectively. As market dynamics continue to evolve, we look forward to supporting our clients in crafting strategies that resonate with both today’s and tomorrow’s homebuyers.

Categories

Recent Posts